Corporate Governance Sustainability

Basic Concept

Under the tag line “SPORTS FIRST,” Goldwin’s mission is to realize a fulfilling and healthy lifestyle through sports. We recognize that it is essential for our business activities to fulfill our social responsibilities as a company, which include compliance with laws and regulations, establishment of internal control, improvement of customer service, emphasis on the environment, thorough occupational safety and health management, protection of human rights, and social contribution. It is also essential that we are trusted by all stakeholders, that we seek to expand our profitability, strengthen/improve our management structure, and that we maintain long-term and stable return of profits to our shareholders.

With this as our foundation, we strive to improve our management fairness and transparency, make accurate and prompt decisions, and execute our businesses efficiently in order to strengthen and enhance corporate governance. We thoroughly instill these ideas in all of our officers and employees through our principle “Strong, Fast, Transparent Management.”

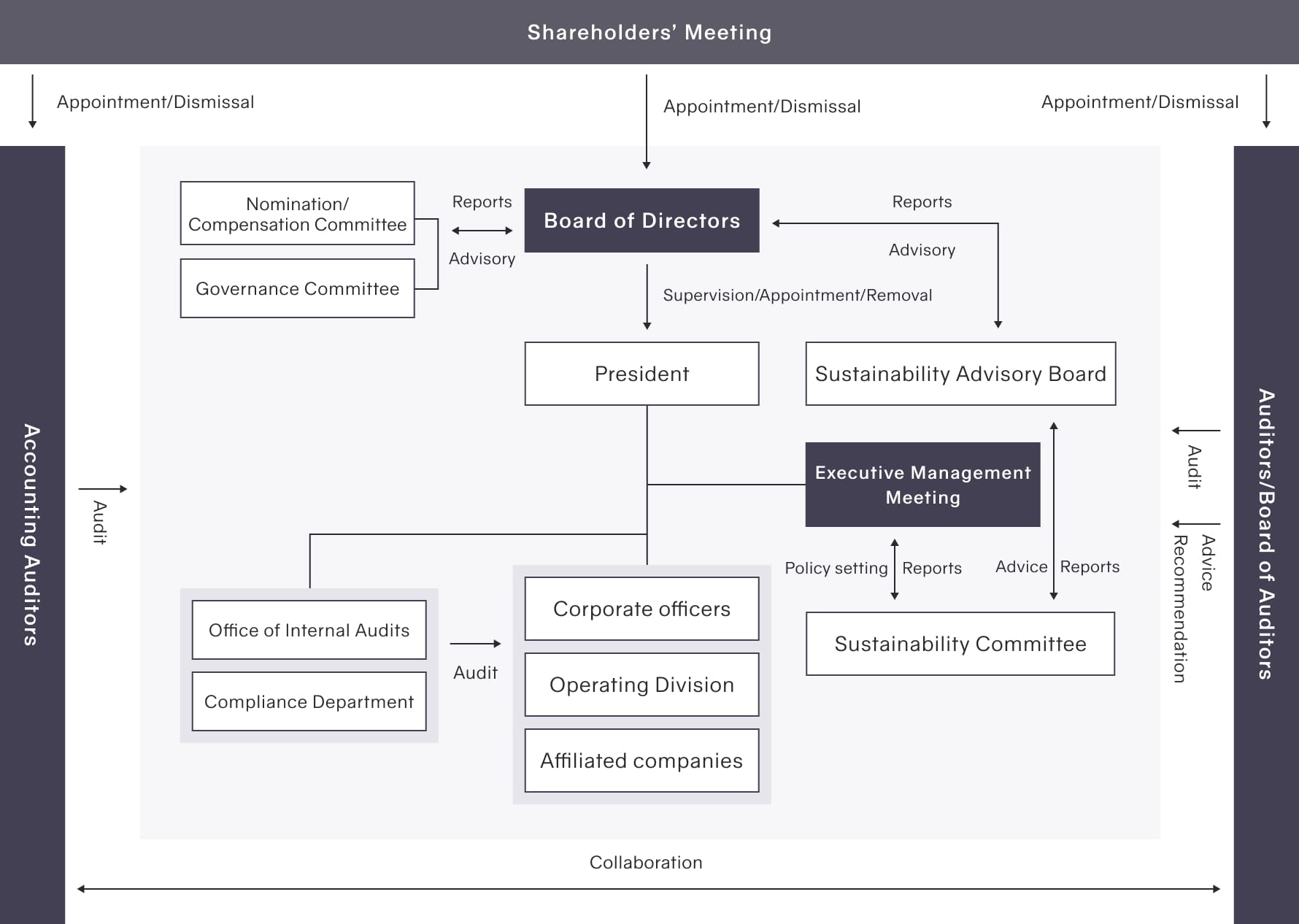

Note: Institutional design is a company with an Audit and Supervisory Board

Note: As of June 25, 2025

External directors:

5 out of 12 directors

External auditors:

3 out of 4 auditors

Female directors:

2 out of 12 directors

| Institutions | Structure | Activities |

|---|---|---|

| Board of Directors |

Chairperson: Executive Vice President 12 directors, 4 auditors |

|

| Nomination / Compensation Committee |

Chairperson: External director 3 internal directors, 5 external directors |

|

| Governance Committee |

Chairperson: External director 3 internal directors, 2 external directors, 1 full-time corporate auditor |

|

| Executive Management Meeting |

Chairperson: President and Representative of Board 7 directors, 2 corporate officers, 1 full-time corporate auditor |

|

| Board of Auditors |

Chairperson: Full-time corporate auditor 1 full-time corporate auditor, 3 external auditors |

|

| Sustainability Advisory Board | 12 directors, 4 auditors, 2 executive officers, 2 advisory committee members (external experts) |

|

Appointment of Directors, Auditors and Corporate Officers

In designating director and auditor candidates, their career, insights, character and other attributes are extensively reviewed by the Board of Directors, which decides the suitability of their appointment based on the content of deliberations by the Nomination/Compensation Committee, an advisory body to the Board of Directors. In the event of a director’s violation of the law or articles of association or a reason deemed to make the rightful execution of other duties infeasible, the Board of Directors deliberates and decides their dismissal or other discipline.

Corporate officers are appointed by a decision of the Board of Directors to contribute to increasing our corporate value in the medium- to long term. The conditions for dismissal of corporate officers are stipulated in the Corporate Officer Guidelines. Corporate officers who meet these conditions are dismissed by a decision of the Board of Directors.

| Directors | Corporate management | Finance and accounting | Human resources and career development | Governance and legal affairs | Research and development | Manufacturing technology | Sales | Marketing | Global experience | Social/Environmental | IT | Sports literacy |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Takao Watanabe (President and CEO) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Eiichiro Homma (Executive Vice President) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||||

| Michio Shirasaki (Director CFO) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||

| Hikari Mori (Director COO) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||||

| Takero Kaneda (Director CSO) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||||

| Hajime Arai (Director CRDO) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Shinji Kawada (Director) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Rie Akiyama (External Director) | 〇 | 〇 | 〇 | |||||||||

| Ichiro Yoshimoto (External Director) | 〇 | 〇 | 〇 | 〇 | 〇 | |||||||

| Dai Tamesue (External Director) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||

| Akira Tsuchiya (External Director) | 〇 | 〇 | 〇 | 〇 | 〇 | |||||||

| Naoko Imoto (External Director) | 〇 | 〇 | 〇 | 〇 |

Appointment of External Officers

The Company has established criteria regarding the independence of external officers, and appoints independent external officers who have no vested interests in the Company. The Company has notified the Tokyo Stock Exchange of all external directors and external auditors as independent directors/auditors. The criteria regarding the independence of external officers require that external officers must not fall under any of the following categories.

- A person who is not currently, or who has not in the past 10 years been, a director (excluding external directors), auditor (excluding external auditors), or employee of the Company and its consolidated subsidiaries (hereinafter collectively referred to as the “Group”).

-

A person to whom, prior to assuming their position, none of the following has applied in the past three years, including the current business year.

- A current major shareholder*1 of the Company or an executive*2 of such major shareholder

-

An executive of a company or other entity that falls under either of the following

- A major client*3 of the Group

- A person in which the Group directly or indirectly holds 10% or more of the total voting rights, or an executive of such

- A person who is employed by the audit corporation that is the financial auditor of the Group

- A consultant, accountant, certified public tax accountant, attorney, judicial scrivener, patent attorney, or other professional who has received large sums of money or other assets*4 from the Group

- A person who has received a large donation*5 from the Group

- An executive of a company to which the Group’s executives are appointed as officers

- In cases where a person who falls under any of the categories in 2 above is an important person,*6 the spouse or relative of that person up to the second degree of kinship

- Not withstanding the provisions of the preceding categories, any other person who is deemed to have to have a special reason that may cause a conflict of interest with the Company

*1. The term “major shareholder” means a shareholder who, at the end of the Company’s most recent business year, holds 10% or more of the voting rights in either their own name or in the name of another person.

*2. The term “executive” means an executive as defined in Article 2, paragraph (3), item (vi) of the Regulations for Enforcement of the Companies Act.

*3. The term “major client” means one whose transaction amounts exceed 2% of either the Company’s consolidated net sales or the client’s consolidated net sales.

*4. The phrase “large sums of money or other assets” means, in the case of an individual, an amount of 10 million yen or more per year on average for the past three business years, and in the case of a corporation, etc., 2% or more of the consolidated net sales of that corporation, etc.

*5. The term “large donation” means an amount of money or other property exceeding 10 million yen per year on average for the past three business years; provided, however, that, if the person receiving the donation is a corporation, partnership, or similar organization, the term means an amount exceeding 2% of the organization’s gross revenue or ordinary income, whichever is greater.

*6. The term “important person” means a director, executive officer, corporate officer, or other executive at or above the rank of general manager, or an executive with equivalent authority.

| Director | Yuko Moriguchi | Attended four of the four meetings of the Board of Directors held until her retirement during the fiscal year under review, and asked questions and expressed her opinions as appropriate based on her abundant experience and insight cultivated over many years as a professional athlete. As a member of the Nomination/Compensation Committee, Moriguchi deliberated objectively on personnel matters and the compensation framework, etc. for representative directors and directors. |

|---|---|---|

| Director | Rie Akiyama | Akiyama attended 17 of the 17 meetings of the Board of Directors held during the business year under review, and asked questions and expressed opinions as appropriate based on her wealth of experience and deep insight primarily as a legal professional. As chair of the Governance Committee, she strengthens the governance framework. Also as a member of the Nomination/Compensation Committee, Akiyama deliberated objectively on personnel matters and the compensation framework, etc. for representative directors and directors. |

| Director | Ichiro Yoshimoto | Yoshimoto attended 17 of the 17 meetings of the Board of Directors held during the business year under review, and asked questions and expressed opinions as appropriate based on his wealth of experience and insight cultivated over many years as a business owner. As chair of the Nomination/Compensation Committee, Yoshimoto deliberated objectively on personnel matters and the compensation framework, etc. for representative directors and directors. |

| Director | Dai Tamesue | Tamesue attended 17 of the 17 meetings of the Board of Directors held during the business year under review, and asked questions and expressed opinions as appropriate based on his wealth of experience and insight cultivated over many years as an athlete. As a member of the Nomination/Compensation Committee, Tamesue deliberated objectively on personnel matters and the compensation framework, etc. for representative directors and directors. |

| Director | Akira Tsuchiya | Since taking office on June 26, 2024, attended 13 of the 13 meetings of the Board of Directors held during the fiscal year under review, and asked questions and expressed his opinions as appropriate based on his abundant experience and insight in system development, digital transformation (DX) promotion, and IT capability enhancement. As a member of the Nomination/Compensation Committee, he deliberated from an objective perspective on personnel matters of the Representative Director and Directors and the composition of their remuneration. |

| Director | Naoko Imoto | Since taking office on June 26, 2024, attended 13 of the 13 meetings of the Board of Directors held during the fiscal year under review, and asked questions and expressed her opinions as appropriate based on her abundant experience as an athlete and experience and insight gained through about 20 years of service at international organizations. As a member of the Nomination/Compensation Committee, she deliberated from an objective perspective on personnel matters of the Representative Director and Directors and the composition of their remuneration. |

| Auditor | Akiyuki Shiobara | Shiobara attended 17 of the 17 meetings of the Board of Directors and 16 of the 16 meetings of the Board of Auditors held during the business year under review, and asked questions and expressed opinions as appropriate based on his wealth of knowledge and experience that he accumulated primarily in related industries and originally from working at a major trading company. |

| Auditor | Hidenao Yoichi | Yoichi attended 17 of the 17 meetings of the Board of Directors and 16 of the 16 meetings of the Board of Auditors held during the business year under review, and asked questions and expressed opinions as appropriate based on his wealth of knowledge and experience that he accumulated primarily in related industries and originally from working at a major trading company. |

| Auditor | Tsutomu Morita | Morita attended 17 of the 17 meetings of the Board of Directors and 16 of the 16 meetings of the Board of Auditors held during the business year under review, and asked questions and expressed opinions as appropriate based on his wealth of knowledge and deep insight primarily as a bank executive. |

Initiatives to strengthen corporate governance

We recognize that upgrading our corporate governance, while also increasing management efficiency, soundness, and transparency, are key issues for improving the common interests of our shareholders, achieve sustainable growth and increase corporate value, and we are strengthening our systems to this end. Specifically, to execute operations swiftly and effectively, we are strengthening our internal control functions and implementing operational rules, including those related to authority and duties, to enhance effectiveness, and establishing a compliance framework, initiating risk management efforts, and ensuring management transparency and fair information disclosure.

About the Board of Directors

The Board of Directors, recognizing its fiduciary and accountability responsibility to shareholders, is committed to the company’s sustainable growth and enhancing corporate value over the medium and long term. In addition to making decisions on key business executions, the Board supervises business operations, primarily led by five external directors. To clarify each director’s management responsibilities and establish a management system that can swiftly adapt to changes in the business environment, the directors’ terms are set at one year ensuring that shareholders’ intentions are promptly reflected.

In fiscal 2024, the Board of Directors prioritized deliberations on the following points.

[Business Plan and Medium-Term Management Policy]

The Board deliberated on the formulation of the business plan and medium-term management policy, along with significant matters related to business execution.

Establishment of the Nomination/Compensation Advisory Committee

To ensure fairness and transparency in decisions regarding the nomination and compensation of directors and executive officers, we have established a Nomination and Compensation Advisory Committee. Composed of a majority of external directors, the committee deliberates on matters related to the nomination of director and auditor candidates in response to consultations from the Board of Directors, and provides its recommendations to the Board.

In FY 2024, the committee prioritized deliberations on the following points.

[Remuneration for Directors and Auditors from June 2024 Onward]

We discussed the total amount of director remuneration, including basic and performance-related compensation.

[Review of retirement age regulations for executive officers]

We discussed the retirement age for directors.

[Establishment of CXO]

We discussed the CXO structure that takes into account global standards.

[Skills Matrix]

We revisited the skills and experience required for our directors and updated the skills matrix accordingly.

[Executive Training]

We participated in a web seminar focused on the role of directors and corporate governance.

[Nomination of Director Candidates from June 2025 Onward]

We deliberated on the candidates for directors from June 2025 onwards based on the updated skills matrix.

Purpose of establishing the Nomination/Compensation Committee

The Nomination/Compensation Committee has been established as a discretionary advisory body to the Board of Directors for the purpose of enhancing the independence, objectivity, and accountability of the Board of Director’s functions in relation to the nomination and compensation, etc. of directors, thereby further strengthening our corporate governance.

Authority and role of the Nomination/Compensation Committee

The Nomination/Compensation Committee deliberates and makes draft decisions on the following matters in response to requests for advice from the Board of Directors.

- Matters related to the nomination of director candidates

- Matters related to the dismissal of directors

- Matters related to compensation for directors

- Matters related to the basic policies and standards for (1) through (3) above

- Matters related to succession planning (including training) for directors

- Other matters for which the Board of Directors requests advice from the Nomination/Compensation Committee

Composition of the Nomination/Compensation Committee

The Nomination/Compensation Committee shall consist of at least three members, the majority of whom shall be independent external directors. The Nomination/Compensation Committee for the current term consists of six members, four of whom are independent external directors.

Evaluating the Efficacy of the Board of Directors

We evaluate the efficacy of the Board of Directors annually. In FY 2024, the efficacy of the Board of Directors was evaluated under the following process. Guidance in survey analysis was obtained from an external organization to increase the transparency of the evaluation.

In FY 2024, a questionnaire survey was conducted in December 2024, and discussed by the Governance Committee in January 2025. As a result, we confirmed that while there is still some room for improvement, the efficacy of the Board of Directors is generally realized.

Evaluation process

- Collection of surveys from all directors and auditors

- Analysis of survey results

- Discussions in the Governance Committee based on the analysis results

Survey items

- Composition of the Board of Directors

- Board of Director operations

- Information provision to external officers

- Improvements from the previous fiscal year

- Overall evaluation

Training for Directors and Auditors

Our internal directors and auditors attend external seminars for the purpose of self-development, including acquiring new ways of thinking and real-time information. We encourage them to join external groups and actively participate in interpersonal networks (exchanges with people in other industries) and add to their knowledge. We hold lectures for external directors and auditors when they begin their appointments to provide them with an overview of our Group, our basic mission and our management plans. After they assume their positions, they attend external seminars, we hold briefings for them on our business activities, and provide Group property and facility tours. Expenses for attending external seminars are borne by the company.

Executive Compensation

Goldwin’s officer incentive scheme aims to provide fair compensation corresponding to each officer’s role and responsibilities, with the basic policy of promoting sustainable growth and improving medium- to long-term corporate value. The compensation system and criteria are revised objectively considering economic conditions, our performance, and criteria at other companies.

Remuneration for FY 2024 (April 1, 2024 to March 31, 2025)

Remuneration for internal Directors consists of basic remuneration, performance-linked remuneration, and non-monetary remuneration, and the ratio of remuneration by type shall be determined by the Board of Directors after consultation with the Nomination/Compensation Committee. The ratio of remuneration by type is 70:15:15 (base remuneration: performance-linked (monetary remuneration): performance-linked (nonmonetary remuneration)). External Directors, who are responsible for supervisory functions, are paid only basic remuneration in light of their duties. Also, the amount of remuneration for each individual shall be determined by the Board of Directors, after consultation with the Nomination/Compensation Committee, within the maximum amount of compensation resolved at the General Meeting of Shareholders.

| Total amount of remuneration, etc. (million yen) | Total amount of remuneration, etc. by type of remuneration, etc. (million yen) | Number of eligible officers | ||||

|---|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration | Retirement benefits | Including non-monetary remuneration claims | |||

| Directors (excluding external Directors) | 395 | 270 | 125 | - | 59 | 7 |

| Auditors (excluding external Auditors) | 18 | 18 | - | - | - | 1 |

| External officers | 72 | 72 | - | - | - | 9 |

Director Remuneration Policy

The Nomination/Compensation Committee has long recognized the relatively low proportion of variable remuneration in the Company’s Director remuneration structure and has conducted further deliberations on the ideal remuneration system for Directors in conjunction with the recent changes to the management structure. In a meeting held on May 22, 2025, the Board of Directors formulated a new remuneration policy for Directors and decided to revise the overall structure of the current Director remuneration system. The new system will be subject to ongoing review in response to the Company’s business growth and changes in the external environment.

Basic Policy

- Instill awareness of the responsibility to enhance corporate value

- Motivate achievement of strategies and business plans

- Set at a level that reflects the weight of each individual’s responsibilities and role

- Set at a level that is socially and market-wise appropriate for the Company

- Set at a level that enables acquisition and retention of top talent

- Keep total remuneration within a reasonable range in light of the Company’s financial condition

Remuneration Structure

◆Remuneration Level

In line with the Basic Policy, remuneration is set at a competitive level appropriate to the Company, according to each Director’s responsibilities and role. In determining the level, objective factors are considered, including economic conditions, Company performance, levels at peer companies of similar size in Japan, and advice or survey data from external experts. Revisions will be made as needed in response to changes in the external environment.

◆Remuneration Composition

Composed of fixed remuneration (basic remuneration and allowance) and performance-linked remuneration (annual bonus and share-based remuneration).

[Fixed remuneration]

- Basic remuneration: Paid in accordance with the scale of responsibilities

- Allowance: Paid for supervisory duties of internal Directors and roles such as committee chairs held by certain external Directors

[Performance-linked remuneration]

- Annual bonus: Short-term incentive linked to the Company’s and the individual’s performance in the current fiscal year, designed to strengthen awareness of annual performance improvement - Share-based remuneration: Medium- to long-term incentive linked to performance over multiple years, aimed at motivating sustainable growth and enhancement of corporate value over the medium to long term as well as promoting the sharing of value with shareholders

◆Remuneration Ratio

[Internal Directors]

To strengthen motivation toward performance and corporate value enhancement, the proportion of fixed remuneration is reduced while performance-linked components are increased. The greater the responsibility and role, the higher the performance-linked and share-based remuneration components.

| Fixed remuneration | Annual bonus | Share-based remuneration |

|---|---|---|

| 44~53% | 28~33% | 18~28% |

For example, the remuneration composition ratio for the CEO is fixed remuneration: annual bonus: share-based remuneration = 44%: 28%: 28% in the case of the base amount (i.e. the remuneration amount when the level of target achievement for all evaluation indicators is 100%).

[External Directors]

Given the nature of their roles, remuneration consists entirely (100%) of fixed remuneration.

◆Timing of Payment

- Fixed remuneration: In principle, paid monthly

- Annual bonus: Paid once a year at a fixed time

- Share-based remuneration: Delivered after the Performance Evaluation Period, with a Transfer Restriction Period in place

Performance-linked Remuneration

Determined based on the degree of achievement of Company-wide and individual performance indicators. Revisions will be made as needed in response to changes in the external environment.

Remuneration Governance

Individual remuneration amounts for Directors are determined by the Board of Directors, within the limit approved by the General Meeting of Shareholders, following deliberation by the Nomination/Compensation Committee, which is chaired by an external Director and the majority of whose members are external Directors.

[CEO]

Remuneration level and structure:

– Proposed by the Chairperson of the Nomination/Compensation Committee to the Committee

– Evaluation: Conducted by the Chairperson and external Director members, with the Chairperson making a proposal to the Committee

[Internal Directors excluding the CEO]

– Remuneration level and structure: Proposed by the CEO to the Committee

– Evaluation: Conducted by the CEO and proposed to the Committee

Details of Director remuneration and calculation method for FY 2025

The outline of the remuneration system for Directors in FY 2025 has been determined based on Director Remuneration Policy.

Fixed remuneration

Fixed remuneration, which is composed of basic remuneration and an allowance, is a monthly monetary remuneration paid in equal installments each month. The amount of basic remuneration is set according to the significance of the role. The allowance amount is a uniform amount set based on the role.

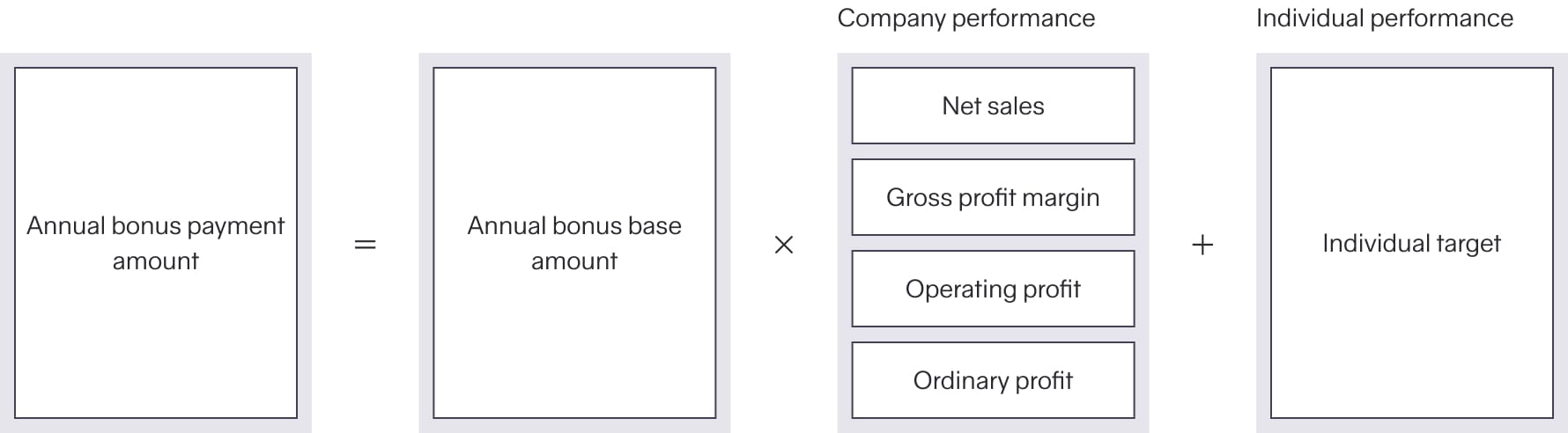

Annual bonus

An annual bonus is performance-linked monetary remuneration paid to internal Directors according to the level of performance achievement of the Company and the individual for a single fiscal year. The base amount is determined by multiplying the total remuneration base amount as Director remuneration (i.e. the amount of remuneration when the level of target achievement for all evaluation indicators is 100%) by a certain ratio, and the amount of payment is determined using a formula based on the performance evaluation figures of the Company and the individual and their composition ratios, as shown below, within a fluctuation range of 0-200%. The payment is made at a certain timing after the Annual General Meeting of Shareholders for the fiscal year. The evaluation indicators and their composition ratios, as well as the maximum value, target value, and threshold value of each indicator for setting the fluctuation range of 0-200% for the payment amount of each individual, are determined by the Board of Directors following deliberation by the Nomination/Compensation Committee.

| Evaluation indicator | Composition | Evaluation details and objectives | Target value | ||

|---|---|---|---|---|---|

| CEO and Vice President | COO, CFO, and CSO | Other Directors | |||

| Net sales | 20% | 25% | 25% | Growth and business expansion over the fiscal year | 141.5 billion yen |

| Gross profit margin | 20% | 25% | 12.5% | Appropriate pricing, brand positioning, and manufacture supply costs | 52.9% |

| Operating profit | 20% | 25% | 12.5% | Expansion of cash flow sources and earning power | 25.7 billion yen |

| Ordinary profit | 20% | 0% | 0% | Strengthening of the profitability of equity-method affiliates | 33.5 billion yen |

| Individual target | 20% | 25% | 50% | Enhancement of strategic initiatives of individuals | ― |

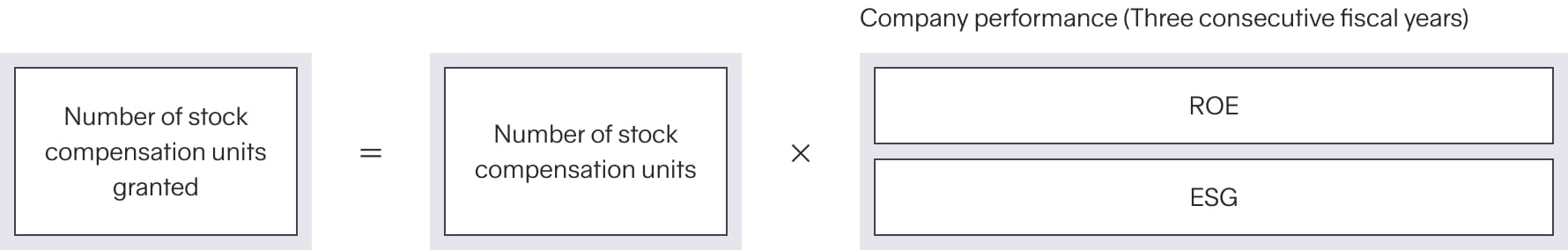

Share-based remuneration

Share-based remuneration is performance-linked restricted shares granted to internal Directors according to the level of performance achievement of the Company for three consecutive fiscal years. Each fiscal year, the Company grants base units calculated based on the base stock price and the base amount determined by multiplying the total remuneration base amount as Director remuneration by a certain ratio. After the three consecutive fiscal years that starts from the fiscal year to which the unit grant date belongs, shares of the Company’s common stock are allotted with transfer restrictions on the basis of one unit per one share following adjustments to the number of units using a formula based on the performance evaluation figures of the Company and their composition ratios, as shown below, within a fluctuation range of 0-200%. The transfer restrictions are lifted at the time of retirement. The evaluation indicators and their composition ratios, as well as the maximum value, target value, and threshold value of each indicator for setting the fluctuation range of 0-200% for the payment amount of each individual, are determined by the Board of Directors following deliberation by the Nomination/Compensation Committee.

| Evaluation indicator | Composition | Evaluation details and objectives | Target value |

|---|---|---|---|

| ROE | 80% across the board | Improvement of capital efficiency and promotion of value sharing with shareholders | 18% (average for three fiscal years) |

| ESG | 20% across the board | Sustainability initiatives | ― |

Remuneration system for Auditors

Given their role of auditing the execution of duties by Directors, performance-linked remuneration will not be introduced for Auditors, and their remuneration consists entirely of fixed remuneration (monetary).

Method for determining officer remuneration

The amount of remuneration for each individual shall be determined by the Board of Directors, after consultation with the Nomination/Compensation Committee, within the maximum amount of compensation resolved at the General Meeting of Shareholders.

The amount of remuneration for each Auditor is determined by discussion at the Board of Auditors. Regarding the maximum amount of monetary remuneration for Directors, it was decided that an annual amount not exceeding 800 million yen (of which up to 100 million yen for external Directors) be proposed at the 74th Annual General Meeting of Shareholders held on June 25, 2025. The number of Directors subject to the resolution is twelve (including five external Directors). The maximum remuneration for Auditors was resolved at the 65th Annual General Meeting of Shareholders held on June 23, 2016 to be an annual amount not exceeding 70 million yen. As of the conclusion of the said General Meeting of Shareholders, the number of

Auditors was four (including three external Auditors).

Approach to Cross-shareholding

We believe that cooperative relationships with various companies in the areas of development, production, and financing is necessary to continue achieving growth in the future. We may therefore hold shares for purposes other than investment, when deemed necessary to increase corporate value in the medium- to long term, after considering the business strategy and business objectives jointly with the business partner.

At the same time, every year, the Board of Directors examines each share currently held based on our policy of reducing cross-held shares that are considered to be of little significance. As a result of that examination, we continue to hold stocks for which the purpose of holding is appropriate and the benefits and risks associated with holding are commensurate with the capital cost. For other stocks, we sell them off promptly, taking into account stock price and market trends.

Exercising voting rights pertaining to cross-shareholding is approved when the resolution being voted on is expected to help to increase our corporate value, or is expected to benefit efficient and sound management for the issuing company and increase its corporate value.