Latest Financial Results Investors

Highlights of FY2026.3 Q3 Financial Results

Q3 Cumulative Results

Cumulative Q3 Net Sales Reached a Record High, with the Operating Profit Marking the Second Highest on Record

The cumulative net sales for FY2026.3 Q3 (April to December) were up 2.7% YoY, reaching a record high of 99,472 million yen.

On the profit front, the gross profit grew to 53,210 million yen (up 5.6% YoY), lifting the gross profit margin to 53.5%, up 1.5 points YoY. In addition, the operating profit was 18,717 million yen (up 10.5% YoY), with the operating profit margin coming in at 18.8%, up 1.3 points YoY. This was partly due to the absence of one-time expenses, primarily related to J-ESOP, that were recorded in the previous year.

Meanwhile, the ordinary profit was 21,617 million yen (down 1.2% YoY) and the net income was 15,251 million yen (down 13.8% YoY) due to a decline in share of profit (loss) of entities accounted for using equity method attributable to YOUNGONE OUTDOOR Corporation in South Korea. However, the net income margin has remained in double digits (in the 15% range), maintaining a high level of profitability.

| Net sales | Gross profit | Operating profit | Ordinary profit | Net income | |

|---|---|---|---|---|---|

| Results(cumulative) | 99,472 | 53,210 | 18,717 | 21,617 | 15,251 |

| YoY(cumulative) | 102.7% | 105.6% | 110.5% | 98.8% | 86.2% |

| YoY(Q3 only) | 101.0% | 103.8% | 100.3% | 104.6% | 86.0% |

|

Sales profit margin ()=Previous year’s results |

― |

53.5% (52.0%) |

18.8% (17.5%) |

21.7% (22.6%) |

15.3% (18.3%) |

| Q1 | Q2 | Q3 | Cumulative | ||

|---|---|---|---|---|---|

| Net sales | Results | 23,878 | 31,711 | 43,882 | 99,472 |

| YoY | 97.1% | 110.2% | 101.0% | 102.7% | |

| Operating profit | Results | 2,079 | 4,880 | 11,758 | 18,717 |

| YoY | 113.1% | 144.6% | 100.3% | 110.5% | |

| Net income | Results | 3,189 | 3,609 | 8,453 | 15,251 |

| YoY | 87.1% | 85.8% | 86.0% | 86.2% |

Sales Trends by Business Segment

Breaking down by business segment, the Performance segment generally remained steady on a cumulative Q3 basis, but was affected by a decrease in inbound demand from mainland China from December onward. Next, in the Lifestyle segment, sales of some winter items fell short of expectations, resulting in Q3 (October to December) performance falling below the previous year’s level. The Fashion segment remained strong, driven by the continued strength of THE NORTH FACE Purple Label.

| Performance | Lifestyle | Fashion | |||||||

|---|---|---|---|---|---|---|---|---|---|

| First half | Q3 | Q3 cumulative | First half | Q3 | Q3 cumulative | First half | Q3 | Q3 cumulative | |

| Net sales | 16,652 | 12,257 | 28,910 | 32,589 | 27,743 | 60,332 | 5,383 | 3,630 | 9,014 |

| YoY | 98.7% | 100.0% | 99.3% | 102.3% | 98.9% | 100.7% | 118.8% | 117.5% | 118.3% |

| YoY(million yen) | ▲ 220 | +1 | ▲ 218 | +733 | ▲ 322 | +410 | +852 | +539 | +1,392 |

| Sales composition ratio | 30.5% | 28.1% | 29.4% | 59.7% | 63.6% | 61.4% | 9.9% | 8.3% | 9.2% |

Monthly Trends

The left side shows monthly net sales for H1, and the right side shows Q3 (October to December).

In Q3 (October to December), monthly net sales were 96% of the plan, and 99% YoY. Meanwhile, the cumulative results for the period from April to December were 99% of the plan and 102% YoY.

In particular, the net sales for December came in at only 87% of the plan, which significantly contributed to the Q3 shortfall. This was partly because of a decrease in inbound demand from mainland China.

| Month | Plan ratio | YoY | |

|---|---|---|---|

| Q1 | Apr. | 107% | 96% |

| May. | 93% | 95% | |

| Jun. | 102% | 101% | |

| Q1 total | 101% | 97% | |

| Q2 | Jul. | 101% | 112% |

| Aug. | 101% | 109% | |

| Sep. | 101% | 105% | |

| Q2 total | 101% | 108% | |

| First half total | 101% | 103% | |

| Month | Plan ratio | YoY | |

|---|---|---|---|

| Q3 | Oct. | 101% | 102% |

| Nov. | 100% | 104% | |

| Dec. | 87% | 93% | |

| Q3 total | 96% | 99% | |

| Q3 Cumulative | 99% | 102% | |

Inbound Sales at Self-Operated Stores

Decreased Inbound Traffic from Mainland China Offset by Visitors from Other Regions

In Q3 (October to December), inbound sales at our self-operated stores grew 14% (114%) YoY. However, in December alone, the YoY figure was 99%.

In December, the inbound net sales from mainland China decreased to 70% YoY. The share of mainland China in total inbound net sales, which had remained above 50% through November, dropped to 37% in December alone.

However, the inbound net sales from countries other than mainland China increased, supporting the overall performance. In particular, the net sales from Asian countries, including Taiwan, Korea, and Thailand, continued to show double-digit growth, with their December share growing to 49%. In addition, although their share remains limited, net sales from Europe and North America also grew significantly.

| YoY | Composition ratio | |||||||

|---|---|---|---|---|---|---|---|---|

| Oct. | Nov. | Dec. | Q3 total | Oct. | Nov. | Dec. | Q3 total | |

| Inbound total | 130% | 118% | 99% | 114% | 100% | 100% | 100% | 100% |

| Mainland China, Hong Kong | 122% | 116% | 70% | 99% | 54% | 52% | 37% | 47% |

| Asia *excluding Mainland China, Hong Kong | 140% | 115% | 127% | 127% | 32% | 33% | 49% | 38% |

| Europe | 167% | 157% | 152% | 160% | 6% | 7% | 4% | 6% |

| North America | 132% | 124% | 146% | 134% | 5% | 6% | 6% | 5% |

| Oceania | 112% | 107% | 109% | 109% | 1% | 1% | 3% | 2% |

| Others | 138% | 145% | 187% | 172% | 2% | 2% | 2% | 2% |

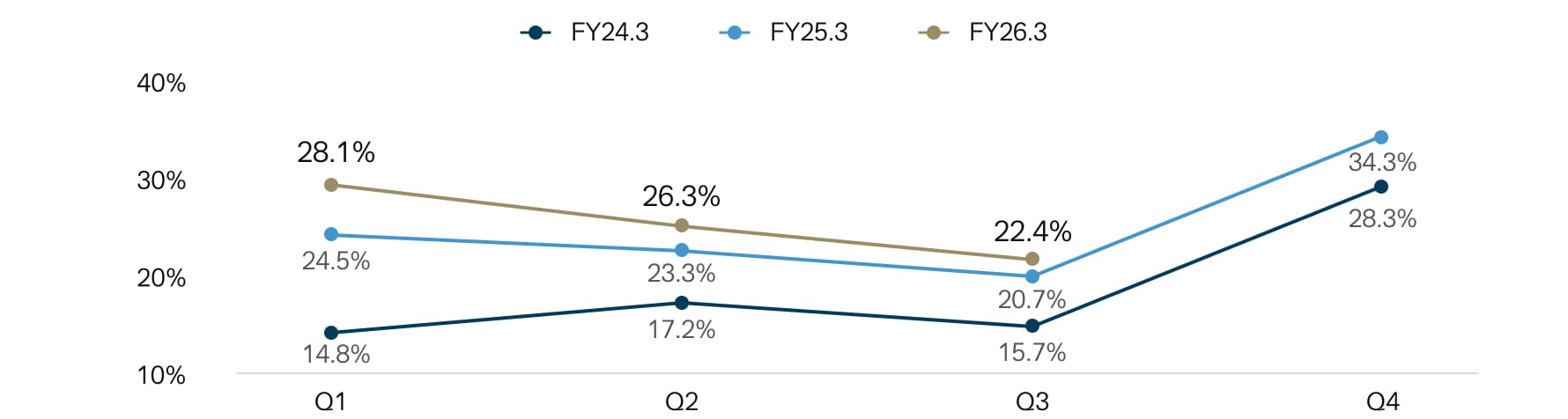

Inbound net sales ratio at self-operated stores (quarterly)

| Q | Month | FY25.3 | FY26.3 | Difference | Share of inbound sales from China |

|---|---|---|---|---|---|

| Q1 | Apr. | 25.5% | 30.9% | +5.3pt | 55.2% |

| May. | 24.2% | 27.4% | +3.2pt | 57.4% | |

| Jun. | 23.9% | 25.6% | +1.7pt | 57.4% | |

| Q1 total | 24.5% | 28.1% | +3.5pt | 56.6% | |

| Q2 | Jul. | 24.8% | 24.3% | ▲0.5pt | 59.4% |

| Aug. | 23.2% | 28.3% | +5.1pt | 65.6% | |

| Sep. | 22.0% | 26.3% | +4.3pt | 57.3% | |

| Q2 total | 23.3% | 26.3% | +3.0pt | 60.9% | |

| First half total | 23.9% | 27.2% | +3.3pt | 58.6% | |

| Q3 | Oct. | 24.6% | 27.9% | +3.3pt | 54.3% |

| Nov. | 17.8% | 18.9% | +1.1pt | 52.1% | |

| Dec. | 20.9% | 22.2% | +1.3pt | 36.9% | |

| Q3 total | 20.7% | 22.4% | +1.7pt | 47.2% | |

| Cumulative | 22.3% | 24.9% | +2.6pt | 53.6% | |

Store Openings for the Goldwin Brand

Store Openings Progressing as Planned. Investment in Brand Foundation, Not Short-term Sales

We will also accelerate store openings outside mainland China, to further expand global brand recognition and strengthen our business foundation.

First, in January 2026, we opened a street-level store on Broadwick Street, located in the heart of London’s Soho. Broadwick Street is lined with boutiques, markets, cafes, and other lifestyle-related facilities. The new store will serve as the brand’s flagship in Europe to enhance customer touch points and communication. In addition to establishing the brand’s presence in Europe, we also expect the store to generate broader exposure across regions through visitors and stakeholders.

Next, we plan to open a store in February 2026 in the Dosan Park area, a fashion-forward neighborhood in Seoul. The store will consist of three floors, from the first basement to the second floor. Offering all product categories as the brand’s largest store to date, it will deepen the brand experience and foster community engagement.

It

should be noted that the main purpose of these openings is not to increase sales in the short term; rather, we view them as strategic investments that will help increase brand recognition, gain deeper customer insights, and optimize our products, promotion, and staffing.