Five-Year Medium-Term Management PlanInvestors

FY2025/03 ~ FY2029/03

A Determined Re-Start After 74 Years

Expanding the Goldwin Brand to Global Markets

Under a Business Model Based on Actual Demand

President and Representative Director

Takao Watanabe

Having emerged through the far end of the COVID-19 pandemic and with the surge in inbound demand, we formulated a new five-year medium-term management plan. Our previous five-year management plan incorporated a long-term vision, Play Earth 2030 as a basic policy. Our new plan will continue with this vision, focusing on the global expansion of the Goldwin brand and growth strategies for The North Face to provide business sustainability. We plan to grow sales of the Goldwin brand to ¥50 billion in 10 years through store formats that reflect regional characteristics and demand, leveraging the strengths of the The North Face supply chain to develop new markets. We shifted to environmentally friendly materials in every brand to support sustainability, and new targets for biodiversity conservation and restoration demonstrate our commitment in this area.

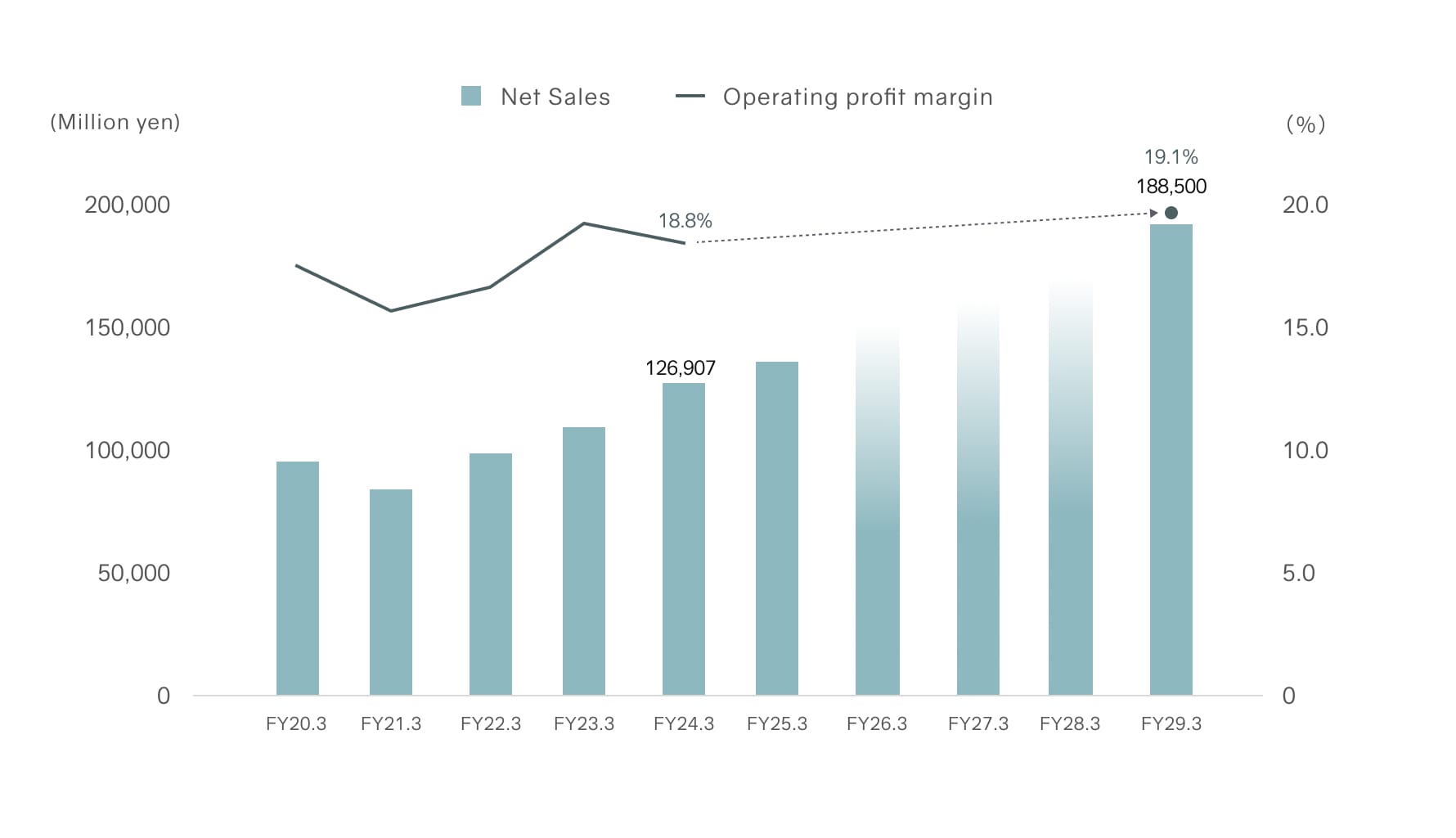

FY2029/03 is the final year of our new five-year medium-term management plan, and our targets for net sales, operating profit, and ordinary profit are ¥188.5 billion (8% average annual growth), ¥36.0 billion, and ¥46.0 billion, respectively.

Basic Policies of the Previous Five-Year Medium-Term Management Plan

(Beginning FY2022/03)

New Five-Year Medium-Term Management Plan

(FY2025/03 ~ FY2029/03)

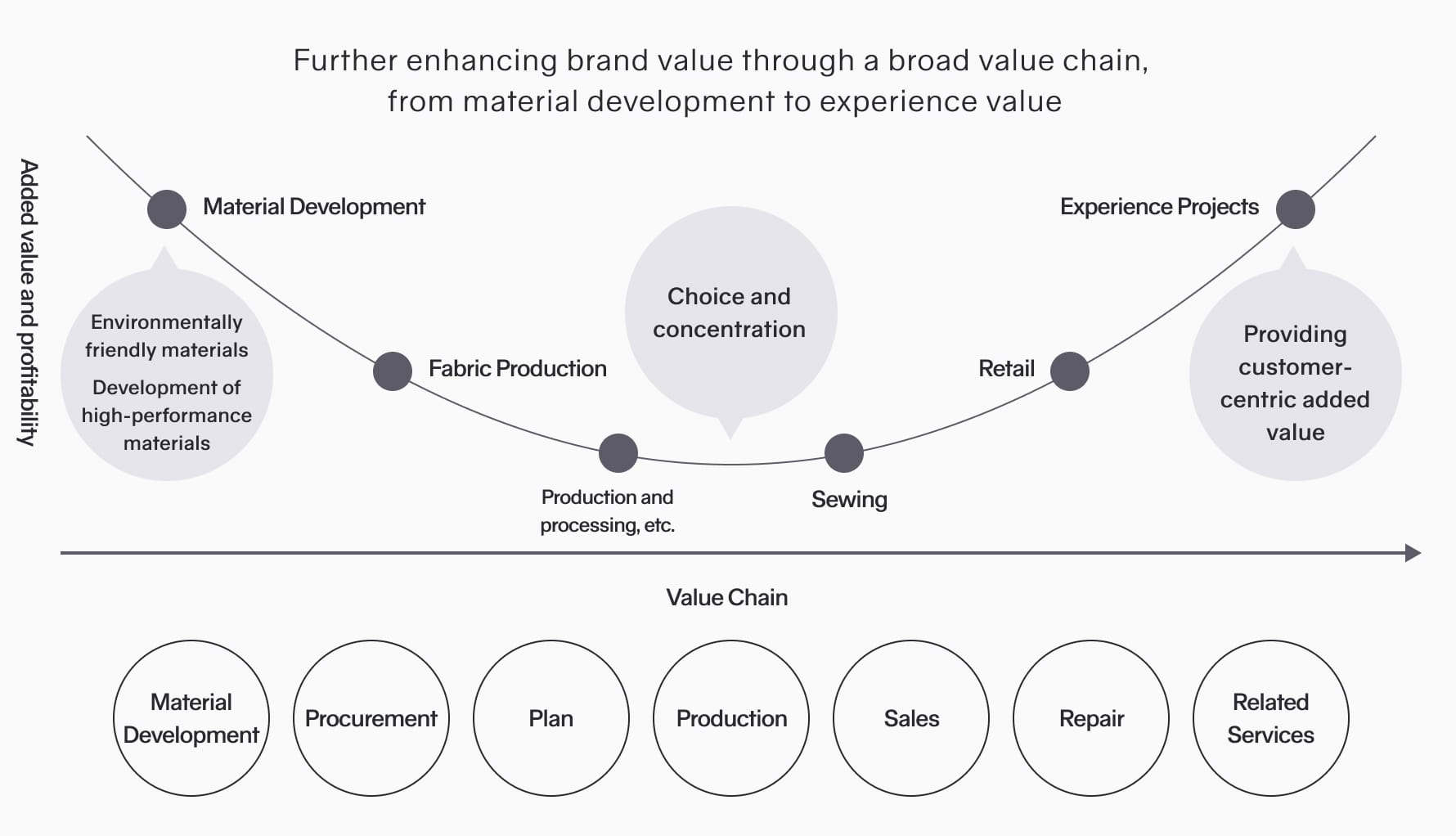

A New Business Model with the Expanding the Scope of

Our Value Chain

Targets

Net Sales CAGR 8% (Six Years Beginning FY2024/03), Aiming to Expand Business Scale

| (Million yen) | FY2024/03 Results |

FY2029/03 Forecast |

|---|---|---|

| Net sales | 126,907 | 188,500 |

| Operating profit (composition ratio) |

23,847 (18.8%) |

36,000 (19.1%) |

| Ordinary profit (Composition ratio) |

32,601 (25.7%) |

46,000 (24.4%) |

| Net income (composition ratio) |

24,281 (19.1%) |

ー |

THE NORTH FACE Market Expansion

Capture New Markets Driven by Stable CAGR of 5%

Director and Senior Managing Officer

Hikari Mori

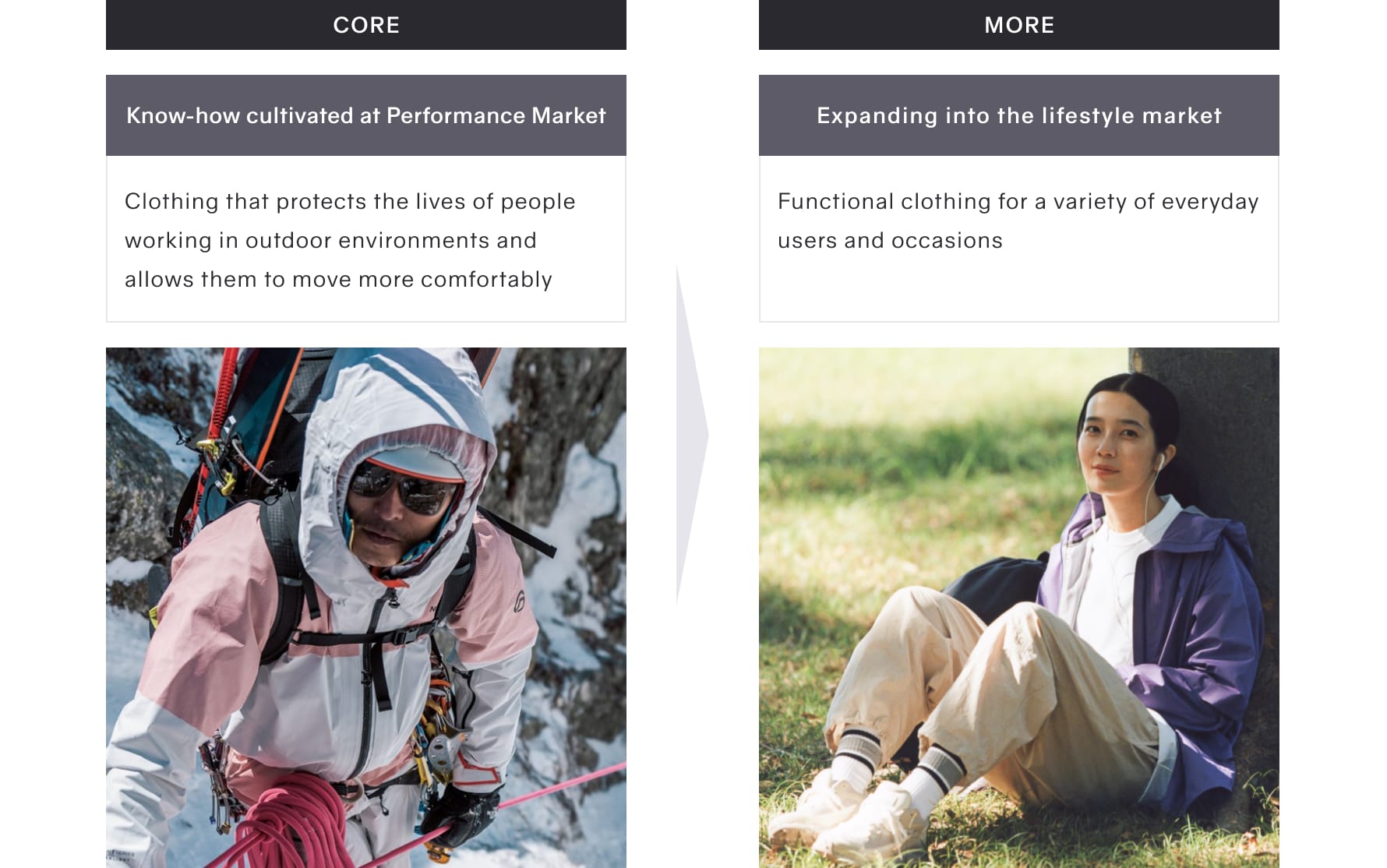

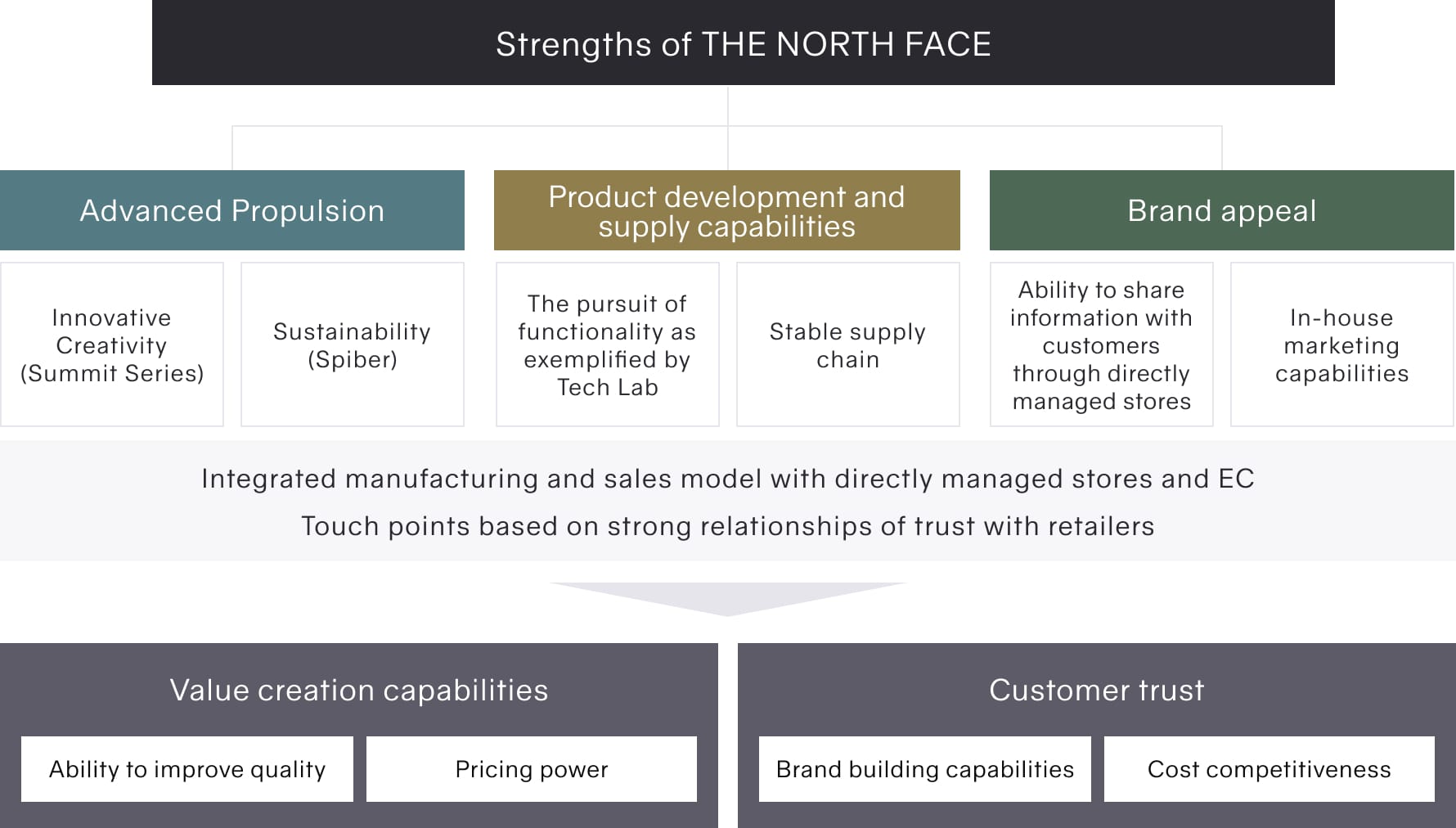

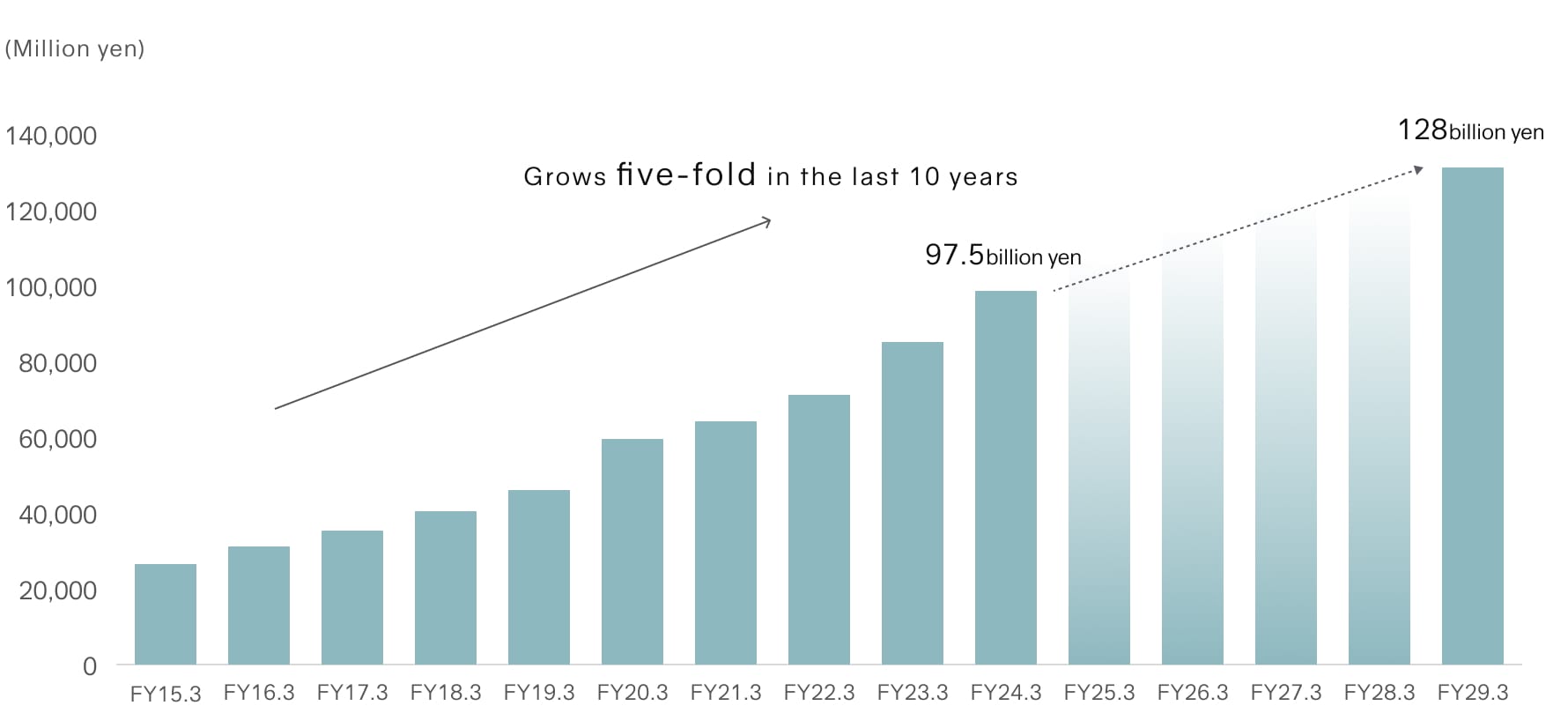

Over the ten years through FY2024/03, The North Face sales grew approximately five-fold, reaching ¥97.5 billion. Our brand value rests on our supply chain, including planning capabilities, production infrastructure, close cooperation with directly managed stores and suppliers, and repairs. The basic strategy of this brand is Core & More. In the Core market, we develop innovative products and materials designed for outdoor activities. In the More market, we extend the functions developed for the Core market to everyday wear, which is useful across a wider range of situations. We will continue to leverage our strengths to develop new markets.

We expect The North Face to grow by approximately ¥30 billion over the next five years, targeting sales of ¥128 billion for FY2029/03.

CORE & MORE Strategy

Expand to Other Business Domains Through the Seamless Integration of Outdoors and Everyday

THE NORTH FACE Growth Potential

Planning for THE NORTH FACE Sales of ¥30 billion + α

Elements Behind THE NORTH FACE Growth

Further technological advances in the performance field

Further promote the current Core & More strategy

Strengthen development of the Summit Series in collaboration with VF Corporation

Strengthening shoes development and creating new markets

Invest in trail running shoes development

Creating a lifestyle market linked to apparel and gear

Appealing to the α generation and strengthening the kids market

Linking with the α generation approach at South Korea YOUNGONE OUTDOOR Corporation

Strengthening kids through the promotion of Green Baton

Sales of core lifestyle products

Product development (Lab) incorporating cutting-edge technology cultivated through performance

THE NORTH FACE Room for Growth

THE NORTH FACE Sales

Goldwin500 Project

Leverage Our Own Resources to Launch Original Brands in East Asia and Other Overseas Markets

Corporate Officer, General Manager of Goldwin Brand Business Division

Shinji Kawada

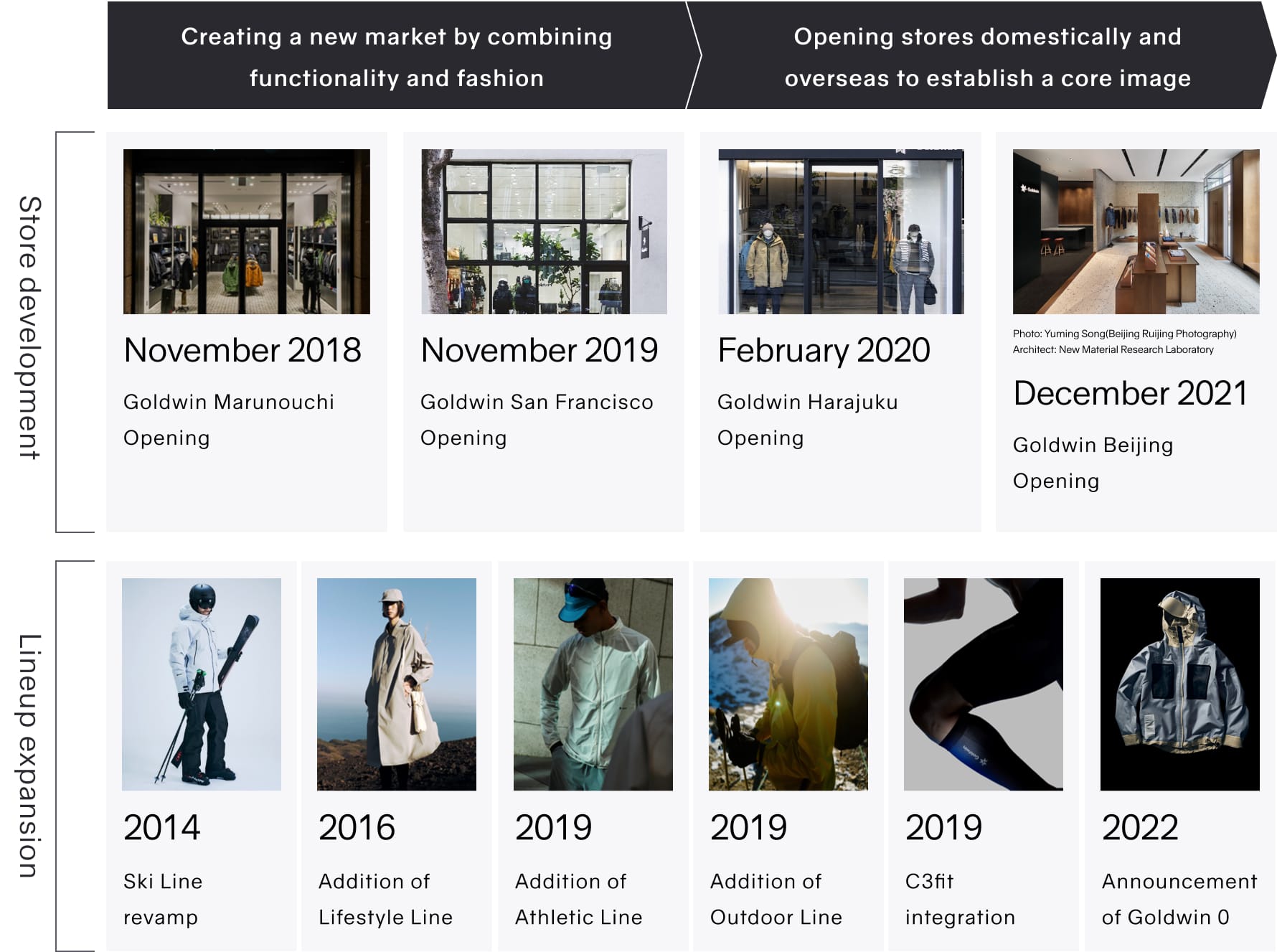

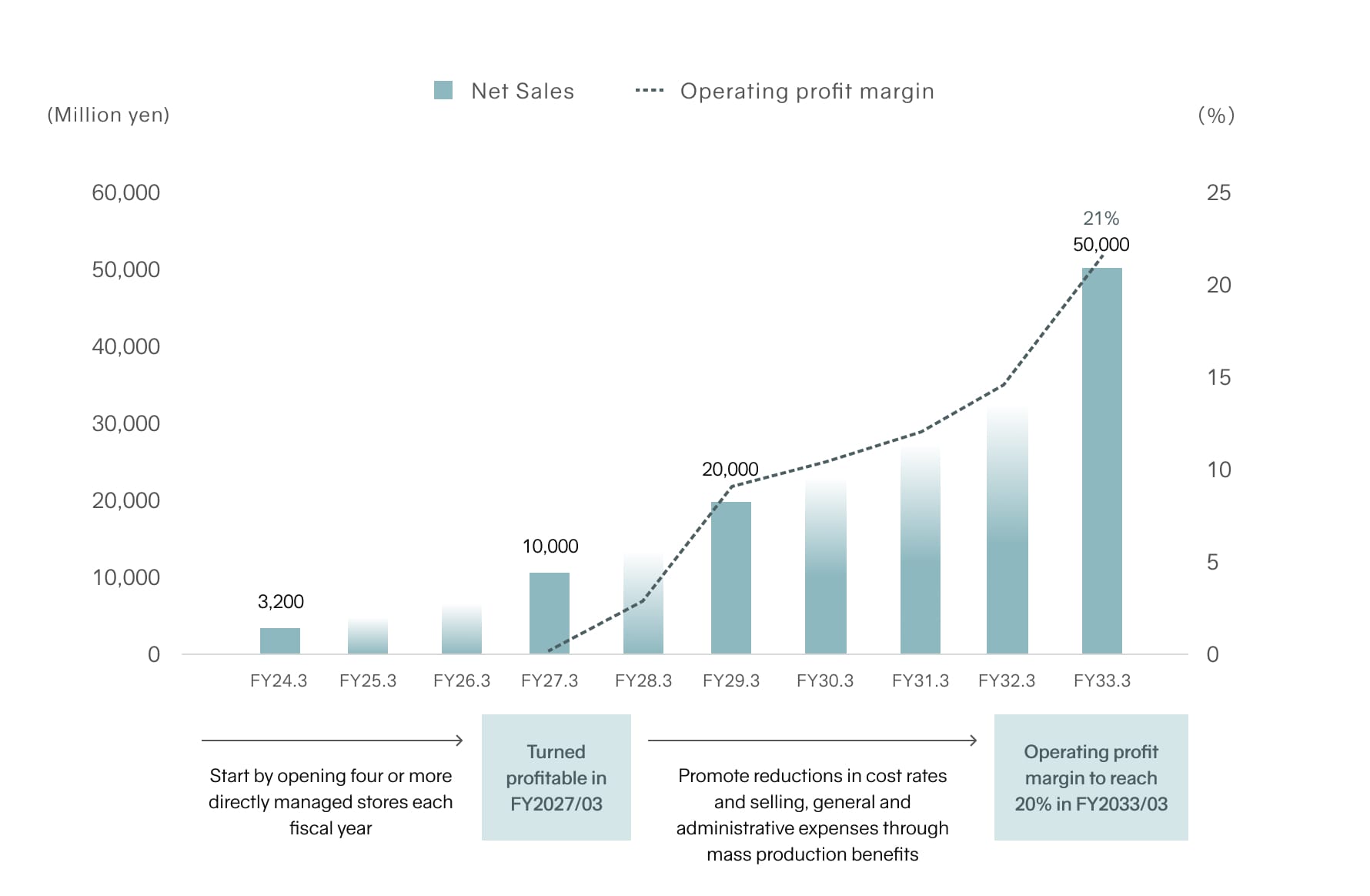

The Goldwin brand offers unique designs in the ski, outdoor, and athletic performance categories. With the launch of Goldwin 0, the brand has expanded into the larger lifestyle apparel market, attracting global attention. Based on the success of our Beijing store in mainland China, we plan to leverage the retail development capacity of local partners in mainland China and our negotiation capabilities to open new stores at a pace of four per year, concentrating on prime locations in first-tier cities. In addition, we are enjoying a high level of interest from fans overseas in response to communications at international exhibitions and through social media. Inbound demand in Japan is a positive sign as we pursue overseas expansion, and we will continue to grow our global presence.

We forecast the Goldwin brand to post sales of ¥20 billion over the next five years, and we target ¥50 billion in sales by FY2033/03.

The Story of Goldwin Rebranding

Accelerating Store Openings in Mainland China

Goldwin Chengdu

Goldwin500 Regional Initiatives

| Region | Initiative Policy | FY2033/03 Net Sales |

|---|---|---|

| Japan | ・Establish a premium sports brand ・Currently expanding to 15 stores |

10,000 million yen |

| Greater China | ・Established a joint venture with a proven local partner to expand business ・Increased recruitment of people with experience in mainland China |

30,000 million yen |

| South Korea | ・Local partner has plenty of business experience (YOUNGONE OURDOOR Corporation) ・Training of personnel for the business |

6,000 million yen |

| Other Asia | ・Training of personnel for the business | 800 million yen |

| Europe | ・Has a local system for business expansion ・Training of personnel for the business |

2,000 million yen |

| North America | ・Developing a business expansion structure ・Training of personnel for the business |

1,200 million yen |

Goldwin500 Earnings Forecast (Global)

Cash Allocation

Growth Investments and Shareholder Returns

Director and Senior Managing Officer

Michio Shirasaki

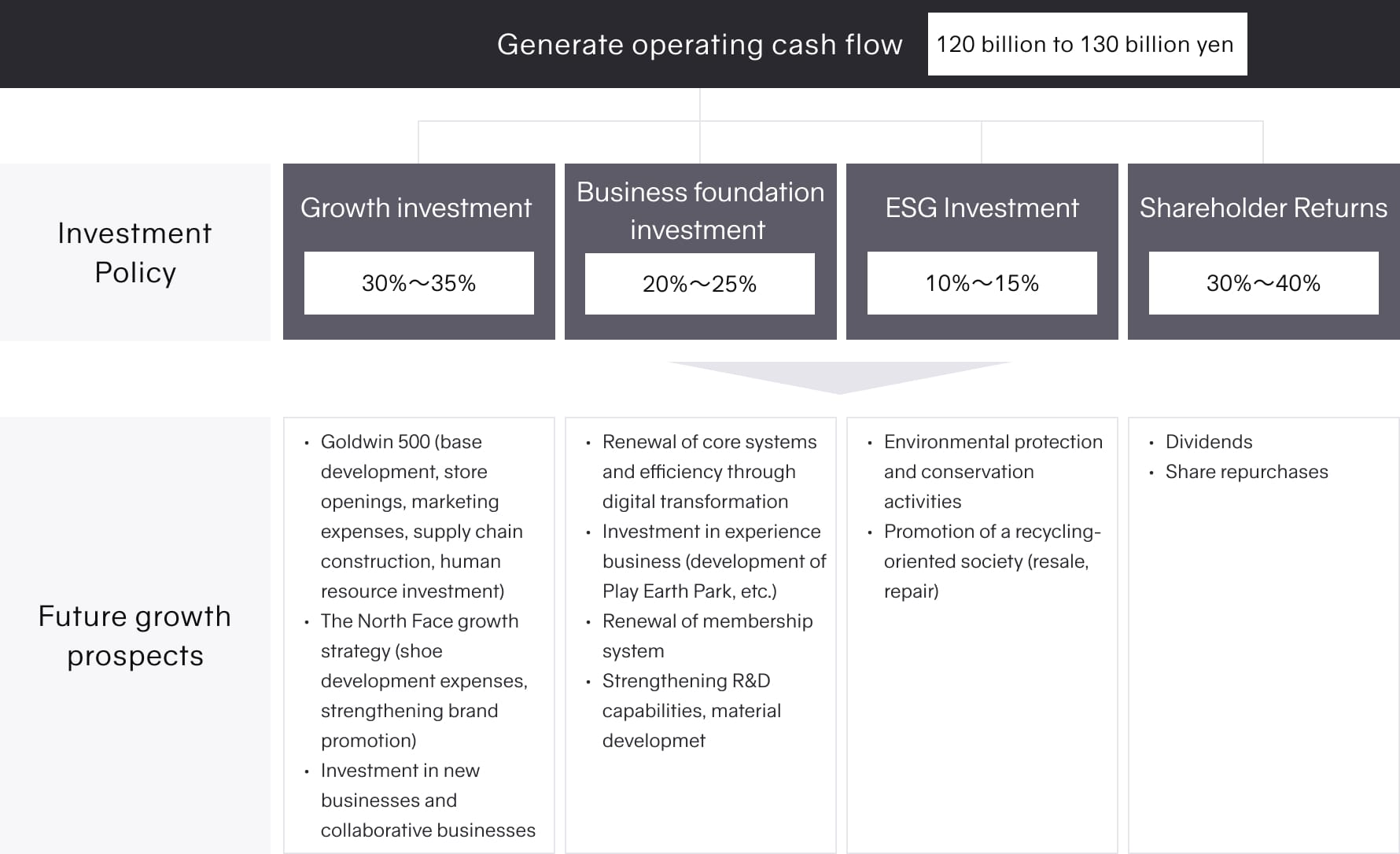

The Company expects operating cash flow over the medium-term management plan to be in the range of ¥120 billion to ¥130 billion. Our policy is to allocate investments to four areas, a large portion of which is investments in growth for the Goldwin and The North Face brands. We also allocate cash for business infrastructure investments in Play Earth Park, ESG investments in environmentally friendly materials development, and shareholder returns. Speaking of shareholder returns, we set a target of 6% or more in dividend on equity ratio (DOE), which is an indicator less sensitive to fluctuations in profit attributable to owners of parent. We will continue to aim for a total return ratio of 40% throughout the medium-term management plan, including share buybacks.

Investments in Growth and Cash Generated from Investments

Capital Policy and Management Conscious of

the Cost of Capital

Key KPIs

| Capital Efficiency | ROE | 20.0% or more |

|---|---|---|

| Shareholder Returns | Dividend | DOE 6% or more |

| Share buybacks | Total return ratio target 40% | |

| Financial Discipline | D/E ratio | 0.3 times or less |

Basic Policy on Capital Management

- Capital Efficiency

-

- Sustainable growth of The North Face

- Accelerate expansion into overseas growth markets

- Review of brand portfolio

- Improve customer satisfaction through membership programs

- Management with awareness of capital costs

- Shareholder Returns

-

- Adopt DOE as a dividend indicator, aiming for continuous stable dividends

- Consider flexible share buybacks and effective use of treasury stock

- Financial Discipline

-

- Review and implement investment and return opportunities while maintaining a sound financial base

Business Sustainability Maintaining a High-ROE Management Structure

| ROE | ||||||||

|---|---|---|---|---|---|---|---|---|

| Increase in sales | Improve sales efficiency | Optimizing capital structure | ||||||

| Improvement Driver | Increase in self-managed sales ratio | Increase overseas sales ratio | Cost Control | Decreasing sales loss rate | Inventory balance control | Shareholder Returns | Control of interest-bearing debt | |

| KPIs | Self-managed sales ratio | Overseas sales ratio | SG&A expenses to sales ratio | Sales loss rate | Inventory Balance | DOE Total return ratio |

D/E ratio | |

| FY2024/03 | 56% | 4.7% | 34.1% | 1.5% | 18.2 billion yen | 8.4% 40.7% |

0.01 times | |

| FY2029/03 | 60% | 10% | 32.0~37.0% | 1.5% | 23 to 27 billion yen | 6% or more 40% guideline |

0.3 times or less | |

| Policy | Aim for a self-managed sales ratio of 60% in the final year of the medium-term plan | Aiming for overseas sales ratio of 10% in the final year of the medium-term management plan | Maintain the 30% range while continuing to invest in growth | Aim to maintain current levels during the medium-term management plan period | Limiting order volume and thoroughly managing inventory flow during the season |

Aim for DOE of 6% or more during the mid-term plan Flexible share buybacks with a target total return ratio of 40% |

Maintain financial discipline | |

We engage in two sustainability initiatives related to the environment and business under Play Earth 2030. Our five-year medium-term management plan calls for maintaining a high-ROE management structure as we expand the markets served by The North Face and Goldwin, enhance brand value, and engage in regenerative activities for the global environment.